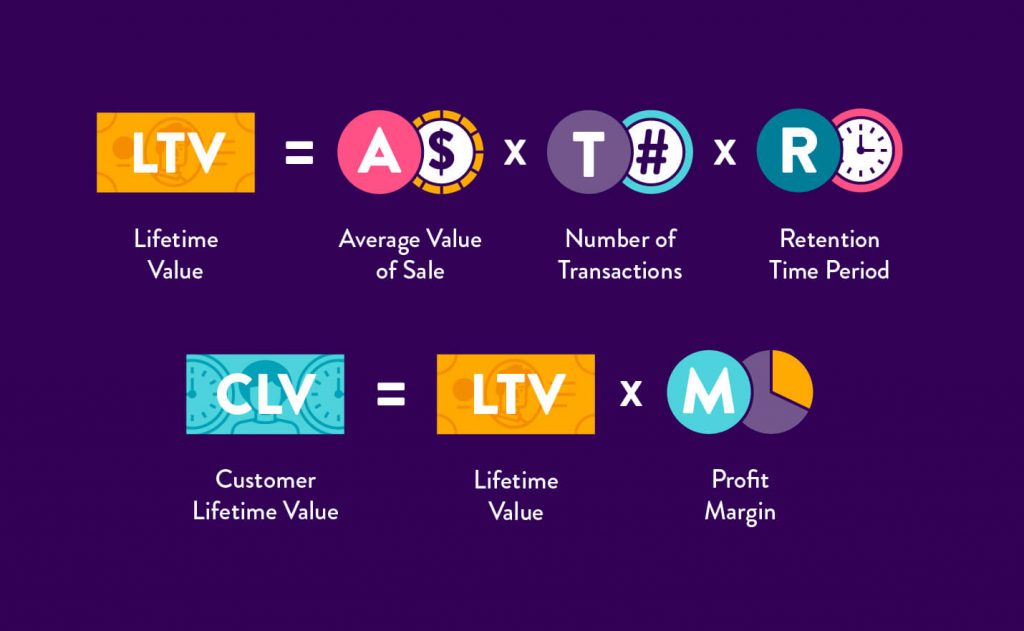

Customer lifetime value (CLV also CLTV) is a metric that shows the total revenue you expect to receive from an individual customer over the life of their relationship with your business.

There are often other options for naming this metric: lifetime consumer value (LCV), or lifetime value (LTV). The term was first used in the book by R. Shaw and M. Stone Database Marketing in 1988.

This performance indicator should be tracked so that the company can understand where to go next. A growing CLV means that customers are happy and will give you more money during the entire interaction, hence the company is doing well. On the other hand, a lower LTV means that the company gets less money from every customer it attracts, and it needs to fix something quickly.

Customer Lifetime Value is quite difficult to determine precisely since the calculation involves predicting the future, and this is a very difficult area not only in business but also in the lives of ordinary people. There are a large number of formulas for calculating CLV, and you can apply them depending on the specifics of your business and your goals.

CLV is also affected by two indicators: Churn rate and Brand loyalty. Churn rate shows the percentage of customers who abandoned your product or service during a certain period. Brand loyalty describes how committed your customers are to your brand. Building brand loyalty can help retain customers and reduce churn.

Here are some possible options of calculations of Customer Lifetime Value

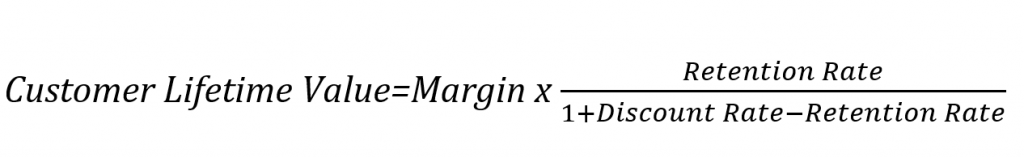

If margins and retention rates are constant, you can use the following formula to calculate CLV:

The Customer Lifetime Value model has only three parameters: constant margin (the difference between price and net cost over a period), constant retention rates over a period (the company’s ability to maintain a long-term relationship with the customer), and the discount rate. The model assumes that if the client is not held, it is lost forever.

ACL (Average Customer Lifespan) =Sum of Customer Lifespans / Number of Customer

CV (Customer Value) = Average Purchase Value / Average Purchase Frequency Rate

The Average Purchase Value (APV) metric is

APV=Total Revenue/Number of Orders

The Average Purchase Frequency Rate (APFR) metric is:

APFR = Number of Purchases/ Number of Customer

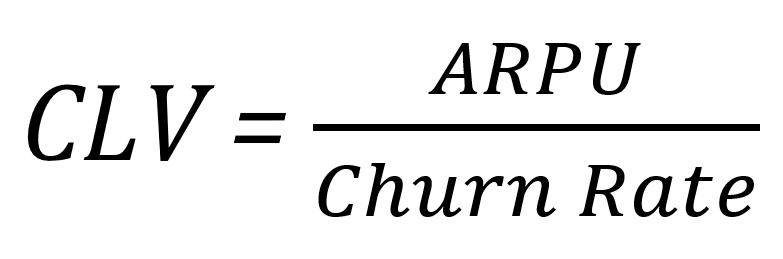

A simpler calculation option for Customer Lifetime Value

ARPU is the average revenue per user. ARPU is considered to be for a specific period of time. You can calculate it using the following formula:

ARPU = Revenue / Number of users

To calculate the Churn Rate, you can use the formula:

Churn Rate = С1/С2 x 100%

С1- customers who rejected your product/service over a certain period of time; С2 – customers who have become users of your product/service over a certain period of time

The higher your customer churn rate, the lower your final Customer Lifetime Value will be.

Despite the large number of formulas for calculating CLV, this indicator is very important for the business. Thanks to it, you will be able to analyze the financial value of your client. This data will help you invest money in the right segment of consumers, as well as optimize your customer retention efforts. All of this will allow you to increase your profit.

To understand the importance of CLV metric I suggest you reading Customers for Life book by Carl Sewell and Paul Brown.

To find more marketing analysis tips go to Marketing Analysis section of the website.